Asset managers enter new era

Tighter regulation aims to mitigate financial risks, protect investors, safeguard growth

China's 120 trillion yuan ($19 trillion) asset management segment, which comprises trust funds, insurance, securities, public and private funds, and commercial banks' wealth management products or WMPs, is on the cusp of a new era of tighter regulation and balanced growth free of systemic risks.

The new regulatory guidelines were approved by the country's top policymakers on March 28. The unified standards and the clear classification of various asset products were released in the form of a draft guideline in November by the central bank.

Backed by the 252 trillion yuan banking industry, the asset management segment had grown rapidly, haphazardly and dangerously in recent years. It is now considered as important as the banks themselves and the financial markets. Hence, any trouble there could have far-reaching implications.

More so because in China, commercial banks play a dominant role in the asset management segment, which has a multi-layer structure that offers complex products.

Divided into two basic categories-publicly offered products and privately offered products-the asset management segment will cover equities, commercial and financial derivatives, mixed products and fixed-income instruments like deposits.

As conventional investments like stocks, bonds and realty lost some of their allure due to reasons like risk, market volatility and low returns, WMPs and the like appear to be the preferred destination of investors seeking high returns, experts said.

Over the past several decades, high wealth accumulation in China has pushed the general public searching for better investment opportunities to prefer WMPs, said Jin Li, chair professor of finance and associate dean of the Guanghua School of Management, Peking University.

But insufficient risk management and aggressive use of financial leverage in the asset management segment often results in massive fluctuation of asset prices, and the capital raised by the financial products does not always flow into the real economy, said Jin.

Asset management firms raise funds from investors by offering higher rates of interest and lend such money to high-risk borrowers on terms that are seen as liberal but are generally outside the purview of normal regulation (and hence not prudential).

Typically, borrowers tend to be real estate companies, local governments' financing platforms and the like.

According to a note by Sun Guofeng, head of the People's Bank of China's financial research division, returns on WMPs are generally higher than bank deposit rates. For example, in June 2017, the average yield of a WMP was 4.66 percent annualized, while the official deposit rate was 1.5 percent.

Returns on WMPs are higher because the products are not subject to reserve requirements, and not covered by deposit insurance, said Sun.

The segment is being sought to be dovetailed with the goals set for the financial services sector in general and the banking industry in particular, to align them with the country's pursuit of high-quality economic growth through structural reforms.

The set of new rules, jointly issued by the PBOC and the supervisors of various financial markets, is the country's first regulatory benchmark to oversee the asset management segment.

New rules specify that asset managers should clarify about their actual investors and investment targets and will be supervised.

The PBOC is aiming to unify rules covering asset management products issued by various financial regulators in the past.

The new rules, which have been drafted since late 2016, became necessary as the segment's growth threatened to snowball into a systemic risk imperilling not only the credit scene but the larger economy.

Experts said tighter regulation is also aimed at improving market transparency and disclosure norms for complex asset management products. This, they said, would help reduce contagion risks from asset management companies or AMCs to the whole financial system.

Another key target is to minimize regulatory arbitrage, thus cutting rent-seeking, according to the country's top financial regulators.

The new rules shall retain provisions related to restricting the so-called non-standard assets, such as trustee loans, that are less transparent and more risky, by financial players and investors, and eliminating complicated structured instruments, to guard against risks and make the financial sector better serve the real economy.

One of the key changes, as seen in the final version of the guidelines, is to assess the value of financial assets as per market prices. This will help measure their net value instead of setting rates of expected return, to better reflect the market risk.

Companies that offer WMPs and other investment products are required not to guarantee returns of principal and profit. Any violation of this rule will make them liable for punishment, the guideline said.

Such rules come in the wake of proliferation of credit by type and volume, including the so-called shadow banking sector, a space where certain financial entities carry out potentially risky credit and related activities outside the regulated banking system.

Tighter rules are seen as regulators' efforts to rein in rapid growth of shadow banking, or the less-supervised asset management products, which have contributed a large part to such growth, becoming a potential risk in the form of banks' unprotected loan exposures.

A report from Standard & Poor's, a global credit ratings agency, said the new rules will speed up the changes in the shadow banking structure.

There are signs that additional regulatory scrutiny of shadow banking activities will continually increase in China, which could be a net positive for financial stability and liquidity risk prevention, said experts.

Through shadow banking activities, banks are believed to have hid loans using alternative accounting practices, thus circumventing regulatory restrictions such as credit allocation constraints. And those activities are mainly channeled through third-party financial institutions, including other banks and non-bank financial institutions.

Given that the global markets are interconnected these days, shadow banking could lead to unpredictable asset price volatility, and pose challenges to monetary policy regulation and financial risk management. In recent years, it has been seen as a major threat to financial stability not only in China but the world over.

As per data from the Financial Stability Board or FSB, by the end of 2016, the worldwide shadow banking assets reached $45 trillion, accounting for 13.2 percent of total global financial assets. It was a 7.6 percent increase from a year earlier.

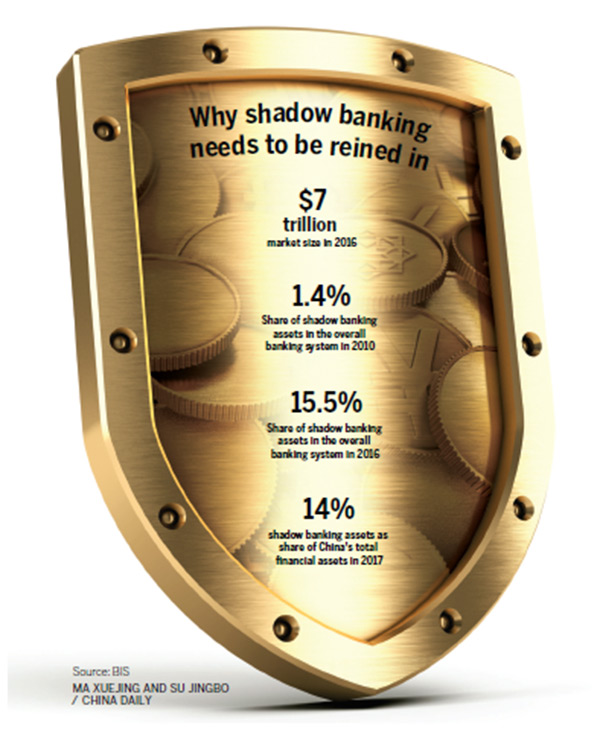

In China, shadow banking products increased to $7 trillion in 2016, rising from 1.4 percent of total global shadow banking assets in 2010 to 15.5 percent in 2016, marking a 40.1 percent compound annual growth rate on an exchange rate-adjusted basis, according to the FSB.

It showed that shadow banking assets have exceeded 14 percent of China's total financial assets, and it is nearly 65 percent of the total GDP in 2017. The segment is now the second-largest globally, just behind the United States where the segment accounts for 31 percent of the GDP.

As China's banking industry still dominates the overall financial sector, banks' WMPs accounted for the largest part of the asset management segment.

As a result of increased regulation, smaller Chinese banks, that rely on the interbank market and shadow banking for liquidity, may see rising funding costs, while larger banks with stronger deposit franchises may be relatively better insulated than smaller, less capitalized peers, experts said.

Fitch Ratings' Grace Wu, who covers China banks, wrote in a research note, "The FSB's narrow measure of shadow banking may not fully capture the range of activities in China due to their complexity", although it is still manageable percentage-wise.

The Fitch analyst saw China's shadow banking "as more systemic and complex" relative to more developed markets, with significant interconnectivity and risk for the banks.

"If the authorities' measures do not slow growth in credit trends, the system will become more difficult to control," said Wu.

In addition, the newly combined supervisory agency for the banking and insurance industries can support efforts to move toward a more comprehensive regulatory framework that can address risks across the financial system, said Fitch Ratings.

"A more unified approach could enhance regulatory oversight and help to limit contagion risks, which would be positive for the long-term stability of the financial system," it said.