Fundraising firms take market by storm

Hong Kong should cash in on the growing popularity of special purpose acquisition companies to capture a slice of the new financing business, investment experts say. But the city must also create a system on a par with Singapore's fledgling program to protect investors. Oswald Chan reports from Hong Kong.

Special purpose acquisition companies — entities formed through IPOs to raise funds for acquiring companies from investors who have no idea what the acquisition targets might be — are making a splash in the IPO market.

Since the start of this year, up to 341 IPOs involving SPACs have been issued worldwide, raising a record US$100 billion as of May 19 — 23 percent more than the figure for the whole of 2020 — with US-listed SPACs dominating the marketplace, according to financial market information provider Refinitiv.

SPACs have been responsible for bringing some of the hottest stocks to market this year, including online betting firm DraftKings, billionaire investor Richard Branson's space-tourism company Virgin Galactic Holdings, and electric-and hydrogen-powered vehicles venture Nikola.

A number of prominent Hong Kong magnates, such as Li Ka-shing and his son Richard Li Tzar-kai, former financial secretary and Blackstone executive Antony Leung Kam-chung, and New World Development's Adrian Cheng Chi-kong, have jumped on the SPAC bandwagon, convinced of the exponential investment returns as ultra-low interest rates in the global financial market drive massive capital into this risk-asset class.

Raghu Narain, Asia Pacific head of investment banking at French investment bank Natixis, explained there are three factors behind the popularity of SPAC listings — ample liquidity in the financial market that is trying to deliver returns; market volatility that creates a price risk for traditional IPOs; and a pool of technology, "environmental, social, governance"-related and healthcare companies that can be targeted for acquisition for growth capital.

In Asia, only South Korea and Malaysia currently allow SPAC listings, while the trend is flourishing in the United States IPO market.

As Hong Kong and Singapore attract a rich pool of new-economy and private technology companies that are based on the Chinese mainland and in Southeast Asia to complete de-SPACing transactions, it raises the question of whether the two Asian financial hubs should jump on the bandwagon. Both cities have sound stock markets, a strong base for institutional investors and sponsors, and ample market liquidity.

The de-SPACing process involves SPACs negotiating mergers and acquisitions so that the targeted company can obtain financing and go public.

Hong Kong Exchanges and Clearing — the city's bourse operator — said last month it will start consultations on changing its rules in the third quarter of this year to allow SPACs to be locally listed.

International law practice firm Mayer Brown expects to see competition between Hong Kong and Singapore as they are eyeing the same acquisition targets on the mainland and in Southeast Asia.

'Asian ecosystem'

"Hong Kong should develop a SPAC listing regime as it will boost capital market development and allow private companies to get listed easily," said Edgar Cheung, senior portfolio manager at Tsangs Group, a family office based in Hong Kong.

"Even if Hong Kong were to start a SPAC listing regime this year, billionaires may allocate some of their capital for SPACs listed in Singapore. The Lion City's financial regulators focus on making deals, while Hong Kong is more concerned with regulations. Hong Kong's financial regulators may not be flexible enough in SPAC listings," Cheung explained.

Narain said that if Hong Kong and Singapore allow SPAC listings, there will be an "Asian ecosystem" of SPAC sponsors, institutional investors in SPAC IPOs, and corporations or target companies seeking to merge with SPACs in Asia, as opposed to the current situation, with most SPAC IPOs taking place in New York. This makes sense, he said.

Hong Kong, as one of the world's top IPO destinations along with New York and Shanghai, and which has raised far more funds than Singapore, still prefers the traditional IPO route. The special administrative region has tightened rules on backdoor listings and shell-company activities to rein in insider trading, stock price manipulation, and unnecessary share volatility.

Moreover, Hong Kong regulators have been simplifying listing procedures and requirements, such as allowing pre-revenue biotech companies to list on HKEX's main board, making companies less keen to take the SPAC route.

Singapore, already with a recent string of company delistings and trailing well behind Hong Kong in IPO fundraising, is taking a more proactive approach. The Singapore Exchange has begun market consultations on introducing SPAC listing regulations, hoping that SPAC listings could provide another attractive option to rekindle the Lion City's sluggish IPO market.

Industry experts say Hong Kong should strike a balance between allowing flexibility in SPAC listings and having oversight in the quality of a SPAC's targeted business. But it is not easy for Hong Kong to find a balance between market competitiveness and enhancing investor protection because of HKEX's stringent rules governing shell companies and backdoor listings.

"For Hong Kong, the current regulatory approach towards shell companies will impede efforts to launch and promote the city as a SPAC listing venue. The Securities and Futures Commission and HKEX will require the acquisition of such target companies by shell companies to go through a new listing vetting process similar to that of the normal listing route," Mayer Brown Corporate and Securities Partner Billy Au told China Daily.

Whether Hong Kong or Singapore will be a successful SPAC listing venue will depend on the regulatory approach Hong Kong takes.

"I think Singapore will be more successful, especially if Hong Kong takes the same regulatory approach regarding de-SPACing activities as it does for current backdoor listing activities. If both cities' SPAC listing regulatory frameworks are similar, I believe Hong Kong will see a greater number of SPAC listings, de-SPACing activities and fundraising exercises, as the number of de-SPACing targets headquartered on the mainland and doing business there is likely to be much more than those in Southeast Asia," Au reckoned.

Narain added, "The context of that merger framework for de-SPACing or business combination would depend on the requirements of Singapore or Hong Kong. But by providing an extensible framework, which is being worked on, the ability to create a vibrant ecosystem is possible."

Other financial analysts prefer to play it safe. "The US SPAC regime cannot be directly cloned to Hong Kong without tailoring," noted Louis Lau, KPMG China capital markets advisory group partner. "While it is important to retain the merits of SPAC listing, careful consideration is required when setting the rules to prevent companies from getting listed which could, in effect, be circumventing existing listing rules," he said.

"Save for setting a list of criteria for gauging the experience and track records of SPAC sponsors, regulators may consider introducing measures to promote a better alignment of interests between SPAC sponsors and investors by tying their economic interests to post-merger growth and the performance of target companies," Lau told China Daily.

Investor protection

Natixis Asia Pacific Head of Mergers and Acquisitions Miranda Zhao highlighted, "I think the potential new Hong Kong SPAC listing regime will have to take into account the city's current IPO vetting system and its reverse takeover rules, as well as the regulator's previous efforts to tighten rules around shell companies and backdoor listings."

Zhao said that a SPAC regime with a more balanced protection mechanism for all classes of investors involved in a SPAC listing and the de-SPACing process could be a positive factor for SPACs to become more a sustainable and attractive tool to support corporate development.

To increase investor protection, Mayer Brown suggests that HKEX highly regulate a SPAC sponsor before and after a SPAC listing. The local bourse operator should identify a core group of the SPAC sponsor management team to disclose the sponsor's respective roles and relevant experience in acquisition strategy in detail so as to enable investors to make informed investment decisions.

After a SPAC listing, the core group of the SPAC sponsor management team should remain as directors of the SPAC for a stated period of time, perhaps 24 months, after the de-SPACing transaction, so that these directors will owe the SPAC their fiduciary duties under the relevant company laws, such as acting in the best interests of the SPAC and its shareholders as a whole, and avoiding any conflict of interest with the SPAC.

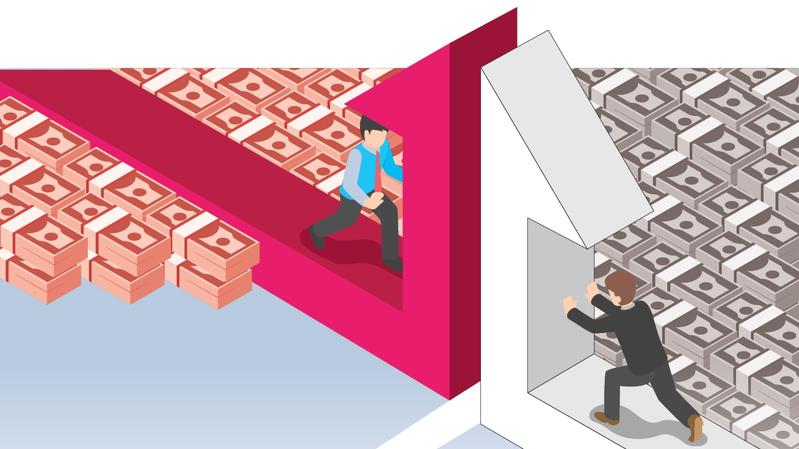

SPACs are usually formed by billionaires, private equity firms, high-profile hedge fund managers and large-scale family offices. It is a viable method of taking companies public in a reverse merger form that provides advantages to investors, sponsors and target firms.

SPAC investors typically put the money raised from selling shares into a trust account that pays interest when the listed SPAC looks for a target to acquire. If no target is found over a specified period, mostly two years, investors will be paid back when the listed SPAC goes into liquidation. If a proposed acquisition turns into a valuable investment, SPAC investors can retain some upside in the company's future business performance. These features will allow SPAC investors to maximize gains when a good merger candidate comes along while the downside risk is fairly protected.

Generally speaking, SPAC sponsors can obtain about 20 percent of the total share capital of a SPAC. Successful SPACs can be very lucrative for sponsors, who will receive their costs from the proceeds and receive a share of the equity that can be disproportionate to the amount invested.

The target company can be certain of getting listed on the main board market, avoiding the risk of failure or delay through traditional IPO applications that are not approved, while the cost of listing is also lower.

Despite its various benefits, SPAC investment may still spell certain risks for investors. SPAC acquisitions pose uncertainty, so investors can only trust the insight and capability of their sponsors. Moreover, the due diligence of the SPAC acquisition process may be far less stringent than that of the traditional IPOs and may lead to fraudulent listings.

- Encounter Shandong: A cultural journey across borders

- 'Chicken steak brother' turns small city into instant hit

- Curtain comes down on Shanghai's popular tourism festival

- Local team effort enables evacuation of hikers from Qomolangma

- Mainland slams Taiwan leader's separatist narrative

- China, Malaysia to hold joint military drill