Tide may turn for Chinese stocks

Stable growth, new listings and market liberalization are driving a cautious sense of optimism

It has not been a particularly good year for stocks listed in the Chinese mainland, but the tide may be turning.

Over the past three years, the Shanghai Composite Index of the largest A-share listed companies lost more than 22 percent of its value. But the upside to this drop is that shares in Chinese mainland markets may now be attractive and accessible enough to appeal to investors from around the world.

Low price-to-earnings ratios, targeted government stimulus and increased consumer spending could help the Chinese economy step on more solid ground, help drive corporate profits and, in turn, push up share values.

So markets may be slowly turning to optimism. A series of measures to increase access to Chinese mainland markets for investors abroad could boost the amount of capital and shore up prices.

Economic growth in China has been slowing in the last couple of years but many now expect it to stabilize at around 7.5 percent this year. That could translate into similar gains for corporate earnings and, in turn, to similar rises in equity prices.

On April 3, the Asian Development Bank released its outlook for the year. It expects growth in China to slow thanks to a series of policies to promote equitable, sustainable and balanced growth.

Zhuang Juzhong, deputy chief economist at ADB, said growth in China could slow as a result of a shift to greater domestic consumption. That same shift could be a key driver of growth across the region going forward.

Throughout last year, China recorded growth of 7.7 percent, the same rate as in 2012 and slightly above the 7.5 percent targeted by the government. The ADB expects GDP growth to slow down slightly to 7.5 percent. Efforts to rein in credit could cut down on investment growth.

"Moderating growth in the People's Republic of China, as its economy adjusts to more balanced growth, will offset, to some extent, the stronger demand expected from the industrial countries as their economies recover," said the ADB.

In March, the official manufacturing purchasing managers' index rebounded to 50.3 (a figure above 50 indicates expansion). The PMI had contracted in February.

This slower but steady growth would be complemented by a series of government measures to boost both economic growth and steps by market regulators to boost share values.

Chinese Premier Li Keqiang suggested on March 19 that the government was getting ready to roll out measures to boost domestic demand and stabilize growth.

After a meeting of the State Council on April 2, Li announced measures including cutting taxes for small businesses, setting up special units in the China Development Bank to fund social housing and infrastructure building, and to speed up railway construction.

"We believe these measures are the right policy responses to the 'fiscal cliff' as a consequence of the anti-corruption campaign, and we think markets will overall welcome them," said Ting Lu and Sylvia Sheng, economists at Bank of America Merrill Lynch.

"These measures show that Premier Li's government aims to stabilize short-term growth with policies which can enhance efficiency while avoiding future financial troubles."

There are no widespread expectations of a massive round of stimulus spending, but there has been a need to soften demand shocks, like those created by the country's high-profile campaign to curb corruption which resulted in widespread cuts in spending. Bank of America expects growth in China to hit 7.2 percent for the year.

The announcement of these stimulus measures did little to boost stocks on the day of the announcement. In fact, the Shanghai bourse ended the day in the red.

Nevertheless, two HSBC economists expect more such stimulus measures in future. Qu Hongbin and Sun Junwei believe that future measures could be part of a wider plan to implement reforms.

"This may be the start of a slew of fine-tuning measures. We think Beijing still has other options in their toolkit, such as the lowering of the entry barriers in various sectors, spending or incentives for environmental protection, as well as more urban infrastructure (such as subways) if needed," they wrote in a note in early April.

The improved growth, coupled with slow but visible improvements in corporate governance and greater access to Chinese mainland bourses for private and institutional investors globally (mostly via Hong Kong) should all help markets rise.

China has also lifted a ban on new listings, which had kept new issues from floating since October 2012. Even after the lifting of the ban, delays are likely to continue for some time thanks to a large pipeline of new deals that has built up.

The China Securities Regulatory Commission officially lifted the ban in December and issued new guidelines for initial public offerings. Estimates suggested that there were as many as 50 companies ready to go public at the end of January and as many as 800 waiting to apply.

The ban was part of an effort to support stock markets. Every new issue could potentially dilute the investor base. Although the SCI has broadly declined in the past three years, it has risen 10 percent since the ban kicked in.

Markets in Shanghai and Shenzhen represent a great opportunity for companies looking for public funds, thanks to 90 million registered investors.

The lifting of the ban has a direct bearing on markets and companies, which may have to wait as long as two years to go to market, according to accountancy firm EY.

"Reforms to the public listing process in mainland China will introduce new rules and expedite approvals, but we'll have to wait another quarter before knowing if this new system is as effective as claimed," said Ringo Choi, a partner at EY, in the company's outlook for private equity for 2014.

China may also see some growth from a proposed series of arrangements that would allow investors in Hong Kong to buy stocks listed on the Chinese mainland.

On April 2, shares in Hong Kong Exchanges and Clearing jumped more than 5 percent on the news, which was reported in the 21st Century Business Herald, a business newspaper in China.

Hong Kong and the Chinese mainland are in talks to expand access to each other's markets.

In a statement, HKEx said it is looking to achieve a breakthrough in mutual market access as part of its strategic plan for 2013-2015.

Last week, Hong Kong was trading at around 22,500 - up from slightly below 18,000 in January 2012, but has not risen above the level it hit in January 2010.

Reports suggest that the Shanghai bourse is already working on the technology needed for the arrangement to work.

As Shanghai opens the door to more foreign investment, it is also doing the opposite, with overseas investment the possible next step.

A report last June in Shanghai Securities News suggested that the People's Bank of China has already approved a trial plan that would allow investors in Guangzhou and Shenzhen to invest overseas, but that approval from the State Council is still pending.

The opening of two-way flows of investment matches up with other moves to liberalize markets.

On March 11, PBOC governor Zhou Xiaochuan said China is looking to liberalize deposit rates, and that this could be achieved over the next year or two.

Four days later, PBOC expanded the trading band on the yuan from 1 to 2 percentage points, a clear step toward allowing markets to set the exchange rate of the currency.

PBOC also made it clear that the move was aimed at punishing speculators who had expected a steady appreciation of the currency. By the end of March, the yuan was trading at its weakest point against the dollar in more than a year.

According to the Shanghai Stock Exchange, the A-share market has a market capitalization of 14.9 trillion yuan and an average price-to-earnings ratio of 10.79.

For China Daily

|

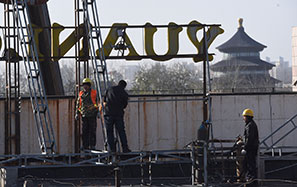

Shanghai's Pudong financial district. The Shanghai Composite Index has lost value in recent years, which may allow investors to buy stocks at an attractive price. AFP |