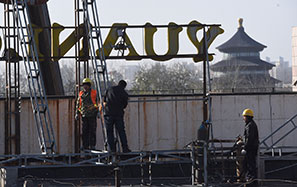

Domestic companies rush to raise dollar-denominated debt

Corporate bond issuers are expected to borrow a record amount overseas this year amid tightened liquidity at home, reports Gao Changxin in Shanghai

Chinese companies are on an unprecedented overseas borrowing drive this year as domestic funding costs edge up, analysts said.

Led by banks and property developers, domestic issuers had sold as much as $20 billion worth of dollar-denominated debt as of May 6, according to calculations by the newspaper National Business News.

Issuers don't seem too concerned about a weaker yuan, which may push up the cost of repaying dollar-denominated debt, or about higher international interest rates as the United States Federal Reserve Board scales back bond purchases.

Analysts forecast that total issues of dollar-denominated bonds this year will surpass last year's total of $50 billion.

China Cinda Asset Management Co Ltd, one of the nation's top four bad-debt managers, is one of the most recent issuers. Cinda sold $1.5 billion in dollar bonds last month in Hong Kong in its debut in the international bond market. The issue had two tranches: five-year debt with a coupon of 4 percent and 10-year debt with a coupon of 5.625 percent.

In late April, Cnooc Ltd, one of China's three biggest oil companies, raised $4 billion in a dollar bond offering in the United States that was five times oversubscribed. And Tencent Holdings Ltd, the Internet giant that owns the messaging service WeChat, raised $2.5 billion in a dollar bond sale in the US.

Another Internet company, Baidu Inc, will sell dollar-denominated debt as well, according to a term sheet seen by The Wall Street Journal on Wednesday. Baidu is seeking to offer a yield for the five-year bond of about 1.5 percentage points above five-year US Treasury debt, or about 3.1 percent, the term sheet said.

The newspaper quoted "a person familiar with the matter" as saying that Baidu could raise about $1 billion with the bond sale, although the exact size of the issue will depend on market demand.

Baidu is rated A3 by Moody's Investors Service Inc and has an A classification from Fitch Ratings Inc. The bond will be sold to international investors, including those in the US, since it is registered with the Securities and Exchange Commission, according to the term sheet.

In China, domestic funding costs are relatively high at present, with the government keeping a tight hold on liquidity in a bid to deleverage the economy.

The People's Bank of China, the central bank, announced that aggregate financing in April was 1.55 trillion yuan ($242 billion), down from 1.76 trillion yuan a year earlier.

PBOC Governor Zhou Xiaochuan has said that the government won't undertake any massive stimulus, suggesting that money supply will remain tight in the foreseeable future.

The yield on 10-year Chinese government bonds, which are used as a benchmark in the bond market, reached a high of 4.05 percent on Wednesday, compared with 3.47 percent a year ago. Yields on top-rated AAA corporate bonds stood at 5.93 percent at the end of April, near a five-year high.

A handful of defaults and near-defaults on debt this year, which are rare in China, have pushed up risk premiums and increased the cost of borrowing, especially for corporate issuers.

The first outright default in China's bond market came on March 7, when Shanghai Chaori Solar Energy Science & Technology Co Ltd paid only 4 million yuan out of 89.8 million yuan in interest due on a 2012 bond issue of 1 billion yuan.

Also in March, the 21st Century Business Herald reported that closely held Xuzhou Zhongsen Tonghao New Board Co, a building materials company, missed a 10 percent coupon payment due March 28 on the 180 million yuan of bonds it sold last year.

Bloomberg News subsequently reported that Sino-Capital Guaranty Trust, the guarantor for the notes, will fulfill its responsibilities. Bloomberg cited "two people familiar with the matter". A default by Xuzhou Zhongsen would have been the first in the nation's private-placement market for high-yield bonds from small and medium-sized enterprises unveiled in 2012, Yang Aibin of Pengyang Investment Management Co said.

And in January, a 3 billion yuan trust product distributed by Industrial and Commercial Bank of China Ltd, the nation's biggest bank, came close to nonpayment before a bailout.

"Default risk is investors' biggest concern at the moment. The market trend is to avoid bonds with low credit ratings," said Howbuy.com Inc, a fund industry consultancy, in a report.

Many companies canceled scheduled bond issues after these developments. For example, a day after the Chaori default, Shanghai-listed Shanghai Jinjiang International Hotels Development Co Ltd canceled a planned 1.6 billion yuan bond issue, citing high funding costs.

On May 6, Shenzhen-listed Tangrenshen Group Co Ltd scrapped a 650 million yuan issuing also due to high costs. And the following day, Linzhou Heavy Machinery Group Co Ltd canceled a 750 million yuan issuance.

International bond yields have also been rising since the US Federal Reserve Board started its "tapering" after years of quantitative easing.

In April, the Fed cut its monthly bond purchase program by $10 billion to $45 billion, down from the highest level of $85 billion.

Some Chinese companies said that they'd abandoned planned bond issues because of volatile market conditions. Others said subscriptions had been insufficient within the targeted rate range. They didn't say if they would pursue dollar-denominated debt issues as an alternative.

Yet even with market uncertainties and rising global rates, the international market is still more attractive to Chinese companies than the domestic market.

For instance, China South City Holdings Ltd, a Hong Kong-listed property developer, offered a 13.5 percent coupon rate on its $125 million dollar bond issue in March. The rate was the highest among all dollar bond issues by Chinese companies so far this year, but it was still lower than developers' average funding cost of 15 percent in the domestic market.

"China is gradually removing distortions from its financial system, and Chinese companies continue to expand overseas (so) the demand for other sources of financing is only likely to grow," columnist Peter Thal Larsen wrote in an article for Reuters.

"The offshore bond boom has further to go".

Contact the writer at gaochangxin@chinadaily.com.cn