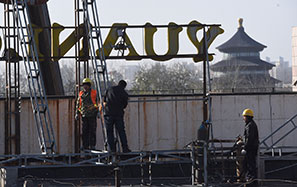

China's stock market bonanza

A mountain of money, pent-up demand and government policies keep the bulls running, but for how long?

After several long years of sluggish performance, China's A-shares market in recent months staged one of the most impressive run-ups ever in global equities markets. Such a bullish run has attracted not only great enthusiasm from domestic and overseas investors alike, but also has drawn many questions from the same crowd at the same time.

For one, China's stock market has displayed a contrary pattern in not following the Chinese economy, instead going in the opposite direction. During the couple of years right after the 2007-08 global financial crisis, China's stock market trailed almost all major indices in the world, despite the fact that the Chinese economy was growing faster than any other major economy.

Things have taken an interesting and surprising turn during the past several months. Despite the sudden and considerable slowdown in the speed of Chinese economic growth, major indices within the Chinese stock market have almost doubled during the same period, leaving investors wondering why the market rallied at this particular time, and for how long the bull market can keep going.

To answer these questions, it helps first to understand why Chinese market rose in the first place.

Nobel prize laureate Milton Friedman once said, "Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output." The same can probably be said of any stock market rally or bubble. Without an accommodative monetary supply, any stock market rally will soon run out of steam.

This may be exactly the reason why the Chinese stock market experienced this rally, despite a subpar economic performance. China's monetary supply has increased more than tenfold since the start of the new century and China now boasts the largest monetary supply in the world, even larger than that of the US, whose economy is still about one-third larger.

In light of such a large amount of incremental monetary supply, the question that has to be answered is: Where will such a large amount of money go? During the past decade, the answer was the Chinese real estate sector.

Real estate was a very attractive investment in China for several reasons. First of all, there was the basic market demand. After years of poor living conditions, many Chinese denizens had a strong desire to improve their living conditions. Secondly, the central government and local governments quickly realized that real estate would lead many other sectors of the Chinese economy and become the driving force of the economic growth. Hence, China rolled out various policy measures to propel the growth of the housing market, which further shaped the expectations of Chinese households and investors, and made real estate even more attractive.

Such basic demand and government support were further boosted by the high leverage of real estate investment and housing prices that only went up until the past year. All this served as a perfect self-fulfilling prophecy: A bullish market attracts more capital and hence sustains the bull market.

However, with growth in the Chinese housing market reaching unprecedented levels in many parts of China, and as Chinese housing prices became higher than those in many developed economies, in absolute terms, the Chinese government and investors both found it hard to sustain that market. Therefore, the nation's attention then turned to the equities market.

Fortunately, after several long years of stagnation, almost all investors in China's equities market felt ready to welcome a new bull market. Further, the valuation of some Chinese listed companies, especially large, blue chip companies that make up the Shanghai-Shenzhen Composite index, was attractive. As a result, domestic and international institutional investors began picking up Chinese blue chip stocks, even if just from an asset allocation perspective.

However, just like many other things in China, the situation can change fast. With the market almost doubling over the past several months, the valuations of blue chips are not cheap anymore. At the same time, the valuations of small and medium-sized companies and companies listed in ChiNext (similar to Nasdaq, for high growth companies) has become so expensive that they dwarfed any index in the world - even the valuations on Nasdaq at their peak during the 1997-2000 Internet bubble.

On the one hand, many institutional investors, experienced individuals and foreigners have started shaking their heads and taking some of their chips off the table. On the other hand, bullish investors note that several government policies, such as more accommodative monetary policies, relaxation of requirements for opening brokerage accounts, and more generous margin trading financing availabilities, all bode well for the market going forward.

After all, many market participants think that the Chinese government is very pleased to see the market go up, and may take meaningful actions to push it up, or at least to keep it up.

Given such encouragement, the Chinese stock market has witnessed an increasingly large number of retail investors, generally referred to as da ma, rush to open brokerage accounts and pour in their money. Such an influx of capital will help the bulls run even farther.

However, as the bullish run becomes more dependent on retail investors, many cannot help but remember what happened when the market experienced a similar magnetizing attraction for retail investors. Right before the Chinese A-shares market crashed from its last peak of 6,100 in 2007, Chinese retail investors had expressed similar zeal with the market, only to suffer from later market slumps and considerable investment losses in ensuing years.

Certainly, there are still valid reasons why the bulls can remain confident, at least in the near term. With the deepening of reforms in many key areas of the Chinese economy, especially in the financial sector, the market can hope for the Chinese economy to stabilize and reform successfully.

During this process, not only will Chinese listed companies' earnings improve, but also listing and information disclosure requirements in the Chinese A-shares market. These measures will be more effective in protecting retail investors and ensuring market fairness and equitability.

Further, with additional liberalization in international capital account flows and domestic interest rate mechanisms, more capital is expected to flow into the Chinese A-shares market. That's another reason many investors bet on the rally to be sustained.

Finally, as is the case in almost every bubble, any Ponzi scheme-like investment bubble is very attractive to investors, as long as one is not the last to catch the time bomb right before the bubble bursts. According to vast amounts of research on historical bubbles and bursts, most investors never believe that they are living through a bubble, much less that they will be the unlucky few who caught the bubble right at its top.

Despite all the upbeat news and reforms in China, all investors still have to bear in mind the basics of finance and investment: the tradeoff between risk and returns. The Chinese real estate market, shadow banking market, Internet financing market and art collection market have all eventually revealed their share of risks in the long run, and so will China's A-shares market, sooner or later.

The author is a faculty fellow at the International Center for Finance at Yale University and deputy dean of the Shanghai Advanced Institute of Finance at Shanghai Jiao Tong University.