A golden opportunity

As global jitters are escalating with economic uncertainty and market volatility, gold looks more attractive. But there’s a big difference between its short- and longer-term prospects.

Those analysts who believe that fear has made a comeback argue that gold is benefiting as equities slide and investors are increasingly concerned about the economic prospects of the U.S., China, Europe and Japan. Yet, even at $1,290, gold still remains more than 30% behind its all-time high of $1,898 in September 2011 amid the U.S. debt-limit crisis.

Although U.S. dollar has not strengthened as much as anticipated, the Fed’s rising rates have contributed to the fall in gold prices. In this view, a reversal may be unlikely because the investor assumption is that the Fed will continue to normalize, though perhaps slower than anticipated.

In the postwar era, such tightening meant a strengthening U.S. economy and a stronger dollar. But at the time, American economy was not haunted by budget and trade deficits or a debt burden. Today, it suffers from both twin deficits and a massive $22 trillion sovereign debt burden.

In this view, the Fed’s normalization may not herald increasing stability, but contribute to instability and mixed signals in the U.S. economy. In that case, rising international uncertainty and volatility is likely to support an upward gold trajectory in the longer term.

Uneasy markets - and gold

Following the burst of the asset bubble in the U.S.(2008), Europe’s debt crisis (2010) and the U.S. debt-limit crisis (2011), markets plunged and gold soared until it peaked at almost $1,900 in September 2011. In the course of the past eight years, these fundamentals have not improved.

As central bankers in major advanced economies resorted to ultra-low interest rates and rounds of quantitative easing, markets tanked along with the oil prices, whereas gold soared. That period prevailed as long as central banks pushed cheap money and bought their multibillion dollar assets, while major advanced economies supported their ailing economies with large fiscal stimulus packages. It was great for gold but bad for equities.

The great reversal began with the Fed’s tightening in 2015, which boosted markets and strengthened the dollar, but penalized gold and oil, which both tanked. This phase accelerated significantly even before the Trump era with the expectation of the new administration’s deregulation, privatization and liberalization. Markets soared, gold lingered.

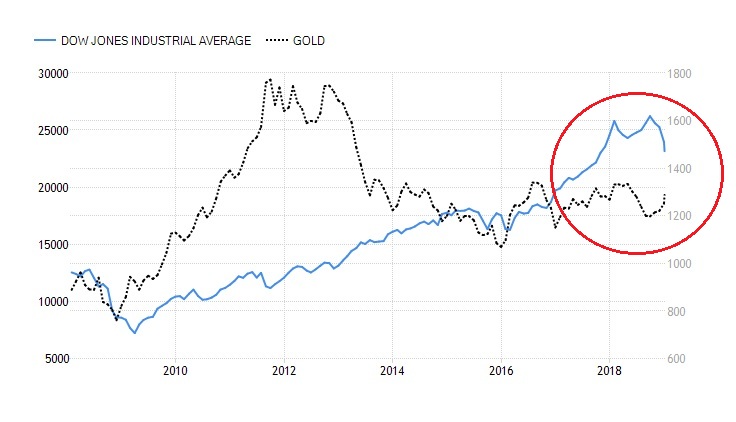

However, as Trump’s agenda became constrained by the Mueller investigation and investors grew concerned about tariff threats that became effective last summer, the mood became more volatile and the sentiment more uncertain. Today, Dow Jones remains more than 13% below its October peak (Figure).

Figure The Post-Crisis Decade: Gold and Equities, 2008-Present

Market forces behind upward trajectory

After its all-time high, gold has been seen largely as a weak asset until 2016, when it began to bounce, along with the Fed rate hikes. While it has advanced to $1,290, lingering uncertainty has resulted in fluctuations, which have effectively penalized further gains, yet prevented new plunges.

Market consensus tends to offer habitual reasons for gold’s upward trajectory. First, market volatility and economic uncertainty are back. Even Trump’s erratic tweets favor gold as a hedge against volatility, which boosts gold prices. And equity market volatility, as measured by the VIX, has tripled in just two months, after a long period of perceived calm.

Second, when a solid asset loses almost a third of its value, as gold did between 2011 and 2016, it becomes more cost-efficient. Gold’s average return is now more attractive.

Third, there’s the dollar story. Historically, a rapidly-strengthening dollar, typically boosted by rate hikes, has undermined gold’s gains. However, as the dollar has stabilized since early summer, downward constraints do not work as much against gold.

Finally, gold tends to be constrained by rising real rates (interest rates minus inflation). Since rising rates raise the opportunity costs of an asset that does not generate income, gold was expected to languish as the Fed would hike rates. But if real 10-year yields have peaked, as some argue, real rates may no longer pose a critical constraint to gold’s advances.

Secular strength in long-term

In the long-term, the picture may look different, however. It is the thriving U.S. economy and markets that keeps gold down. But have American fundamentals improved since 2011 debt-limit crisis? After all, today U.S. sovereign debt is twice as large as in 2011. And, according to CAPE (cyclically-adjusted PE ratio), equity valuations are almost twice as high as the historical norm – even amid the government shutdown.

Moreover, U.S. economy is no longer the key driver of global growth prospects; China and other large emerging economies are.

In long term, secular stagnation is set to broaden across the major advanced economies, which cannot be disguised by hyper-aggressive monetary policies, such as ultra-low rates, quantitative easing, or overpriced markets.

That’s one reason why several large emerging economies, which today fuel most of global growth prospects, and major oil exporters, are intrigued by the idea of re-coupling gold with a multilateral currency basket to avoid excessive exposure to U.S. denominated energy and commodity markets.

As China-supported One Belt One Road (OBOR) initiatives advance, U.S. dollar is being effectively sidelined by the yuan and other emerging-country currencies. Moreover, over time the OBOR is also likely to have a substantial impact on the gold market as it takes place in regions rich in mining resources and accounts for a vital share of global gold supply and demand.

Furthermore, there have been interesting shifts in gold reserves. While advanced economies, such as the U.S. and Germany, still own most global gold reserves, the U.S. has increased its gold holdings in the past decade only marginally, while Germany has been forced to cut its reserves. In contrast, China has tripled its reserves, while Russia has nearly quintupled its gold (after dumping billions of U.S. Treasuries), despite rounds of sanctions.

As some 90 percent of the physical demand for gold comes from outside the U.S., mainly from large emerging economies that are also fueling global growth prospects, gold is on the right side of the future.

Dr Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and EU Centre (Singapore).